The State of Crypto M&A 2022

Monday, August 8, 2022

TL;DR: Crypto M&A activity shows all signs of strength, despite a “bear market” in crypto prices and negative public sentiment.

If you want to keep a firm handle on what is moving the crypto industry then keep reading and download the full Crypto M&A report for free here:

Enter email to receive a link to download the survey results

Deal Activity: Acquiring the 2022 dip

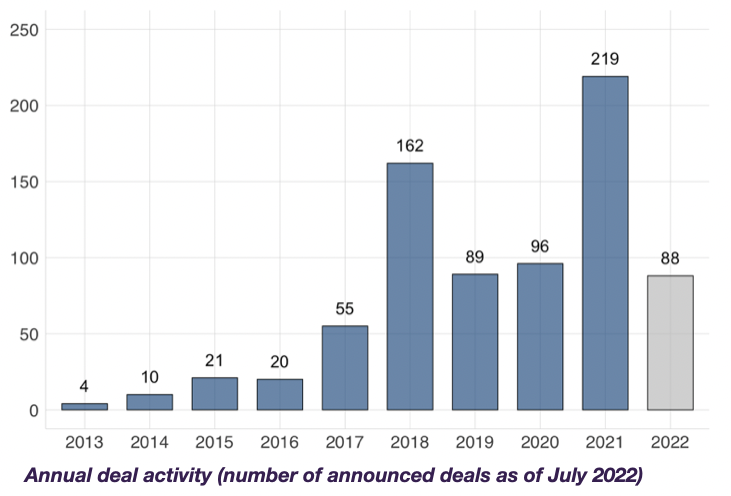

With crypto prices and sentiment down >75% from last year’s peak, M&A activity is still showing relative strength. While total deal activity might not reach the peak of 2021, it’s on track to surpass 2020 and the previous high of 2018.

We expect well capitalised crypto companies and protocols to take a more aggressive stance to go on an acquisition spree, now that valuations are at healthier levels and the crypto industry is focusing more on traction and product-market-fit.

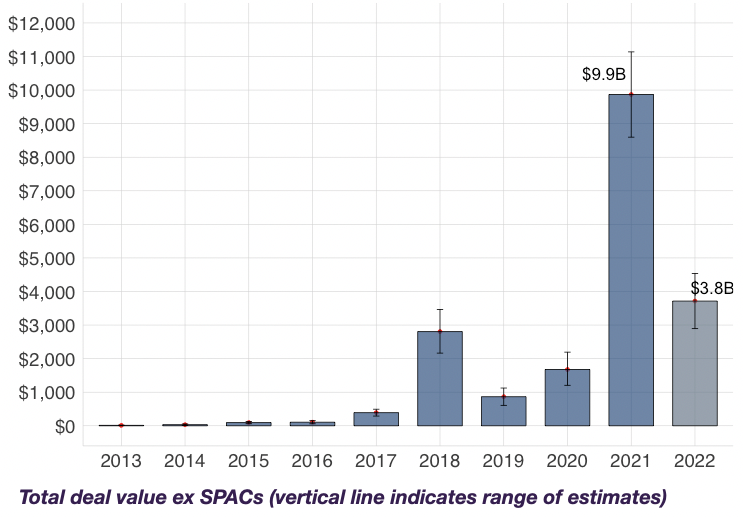

Deal Value: Waiting for the next billion dollar deal

2022 deal value is on track to come in roughly 20% below the $10B we estimated for 2021. This is in line with what we’re seeing in outright deal activity, and excludes deal values from reverse mergers and SPACs.

The crypto industry has seen two billion dollar mergers so far: Galaxy Digital – BitGo ($1.2B) in 2021, and Bolt – Wyre ($1.5B) in 2022. We expect at least one billion dollar acquisition to happen before year-end to reflect the trend of private market valuation resets and industry consolidation.

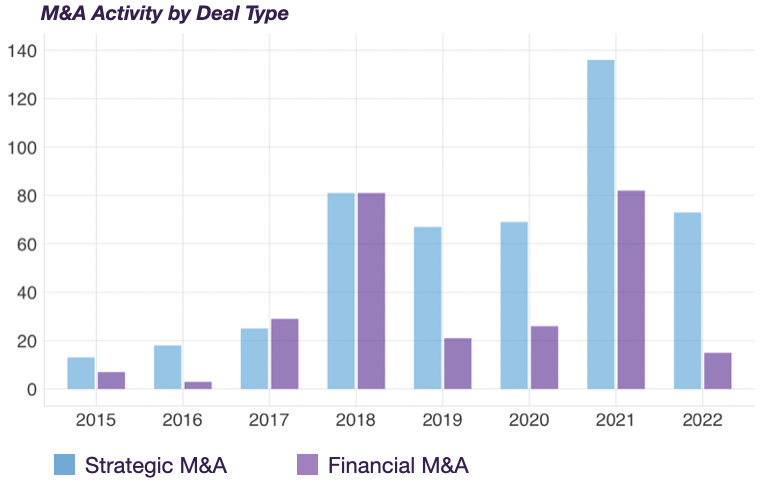

Strategic M&A: Anything but “dead”

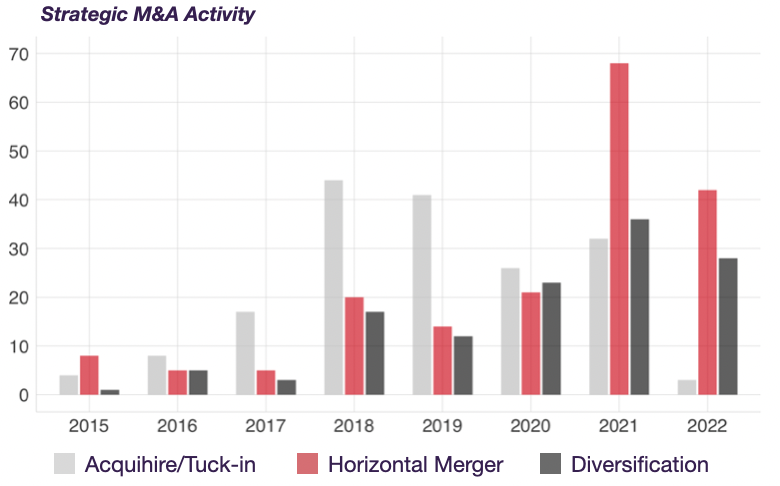

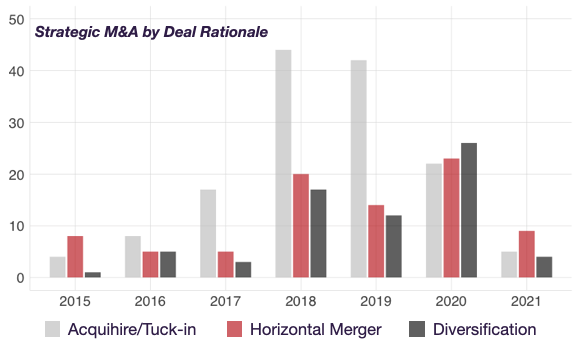

The 2017-18 market cycle saw a rapid increase in opportunistic Financial M&A (reverse mergers, private equity), which quickly dropped off after. This repeated in 2021 with a sharp increase in SPACs and private equity deals. Unsurprisingly, this opportunistic activity has dropped off sharply with the recent downturn. While Financial M&A has died once again, Strategic M&A is on pace to match or even surpass 2021. We see this as a signal of strength and maturity the industry needs.

Similarly, while smaller acquihires and tuck-ins drove M&A activity pre-2021, the industry is now of such a scale that horizontal consolidation and diversification mergers are the typical deal drivers.

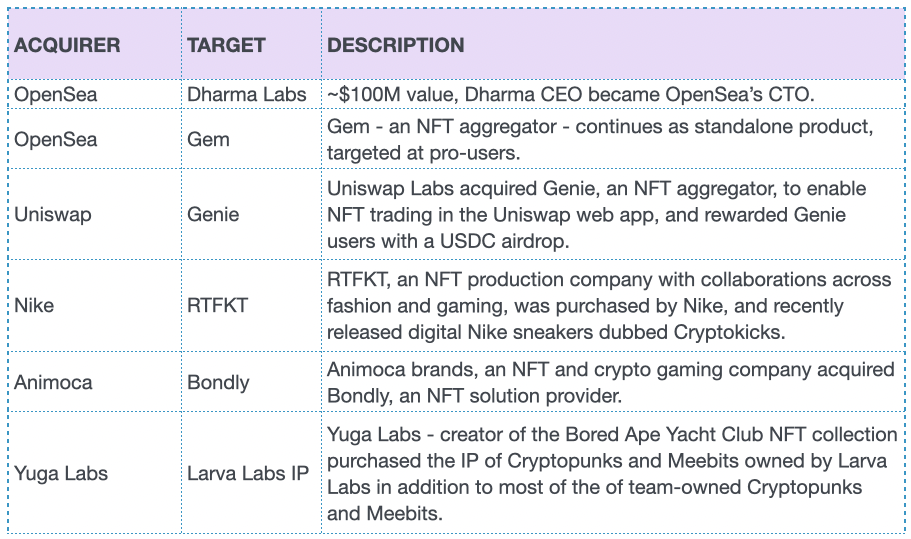

NFTs: Emerging deals

10% of all Crypto M&A activity since 2021 involves companies that are active in the NFT and blockchain gaming subsector. OpenSea, the most prolific NFT company in crypto, has started to become active in M&A with two high profile acquisitions in the past year. OpenSea acquired Decentralized Finance startup Dharma Labs in early 2022. OpenSea’s trajectory is similar to what Coinbase went through in the 2017/18 cycle: It’s the clear incumbent in a crypto sector, has a decent warchest and this is likely to translate into an M&A strategy over the coming two years.

Full Report

Download the full report to get a data-driven overview of all Crypto M&A, including additional topics such as:

- Decentralized M&A: Protocol and decentralized applications are merging at rapid pace.

- Regulatory Impact on M&A: We are seeing a significant increase in regulatory driven M&A right now, as agencies across the world are making significant strides.

- Forecasts: Crypto M&A will accelerate into 2023.

Enter email to receive a link to download the survey results

The State of Crypto M&A 2021

Wednesday, May 26, 2021This is our third landmark publication about M&A activity in the cryptocurrency sector.

TL;DR: Crypto M&A activity points at an industry that is in a much better state than the 2017-18 cycle.

If you want to keep a firm handle on what is moving the crypto industry then keep reading and download the full Crypto M&A report for free here:

Enter email to receive a link to download the survey results

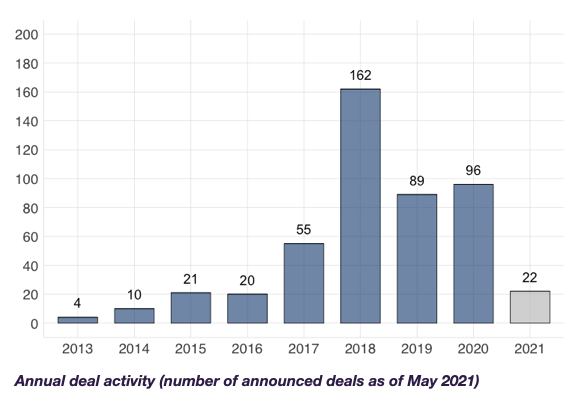

Deal Activity: Steady stream of transactions

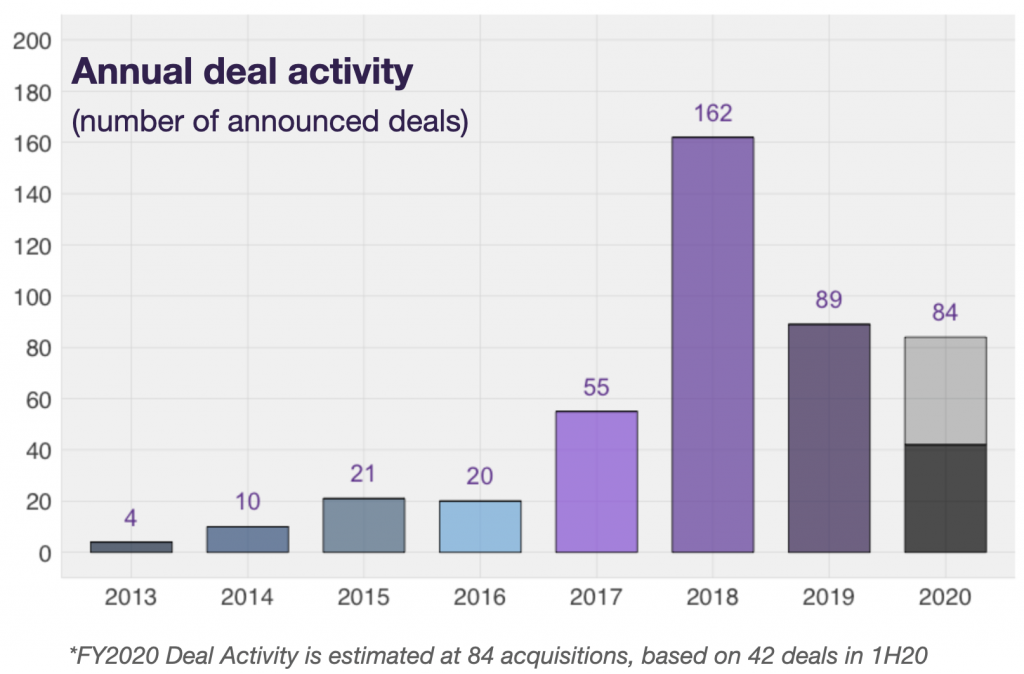

A total of 478 M&A transactions have taken place in the cryptocurrency and blockchain industry since 2013. Despite early concerns of a slowdown caused by the pandemic, 2020 saw a moderate (10%) increase in deal activity from 2019. The bullish market sentiment and private market fundraising dynamics are likely to lead to increased deal activity and competitiveness in 2021.

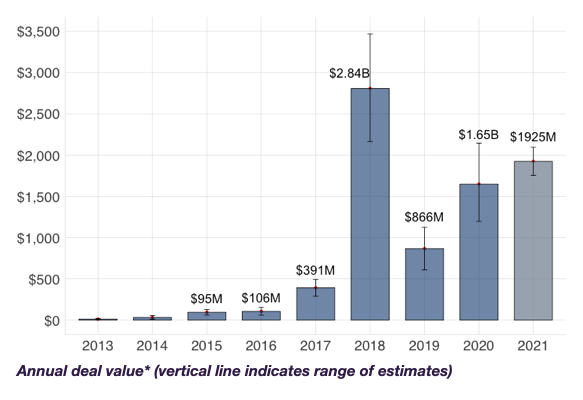

Deal Value: New records are set

While deal activity in 2020 increased only 10% over 2019, total deal value doubled to $1.7B. This was largely due to a handful of large acquisitions in the exchange space including the $400M acquisition of Coinmarketcap by Binance and FTX-Blockfolio transaction for $125M. This trend has continued into 2021, culminating in the record setting Galaxy Digital acquisition of BitGo ($1.2B). This transaction has caused 2021 ytd to leapfrog 2020. Barring a sudden (negative) shock to the crypto market, 2021 is set to become a record year and we expect more billion dollar deals to happen.

Strategic M&A: Shift towards consolidation

M&A activity falls into two categories: Strategic and Financial. The 2017-18 market cycle saw a rapid increase in Financial M&A when 50% of all activity was financial of nature and caused by investment funds, defunct corporations (e.g. Long Island Blockchain…), and obscure reverse mergers.

Unsurprisingly, this opportunistic activity dropped off when crypto market sentiment turned in 2018-19.

Deal activity has been predominantly strategic since, and a closer look reveals a maturing industry that is shifting away from acquihires and smaller “tuck-in” acquisition towards larger horizontal and diversification mergers.

Sectors: Exchanges and Crypto banks are dominant

Exchanges have consistently been the most prolific acquirers in crypto contributing more than 40% of all deal activity and 60% of deal value since 2013. Through multiple acquisitions in the custody, brokerage and infrastructure subsectors, incumbents such as Coinbase, Kraken and Gemini have evolved into full service crypto banks. The institutionalisation of crypto, bullish fundraising climate and Coinbase IPO will lead to increased M&A competition in 2021 between exchanges and other crypto financial services companies. The first billion-dollar takeover (Galaxy Digital – BitGo) and trading venue acquisitions by Coinbase (Skew) and Blockchain.com (AiX) are signs of what’s to come.

Decentralized M&A: NuCypher & Keep Network

2021 already is a landmark year for M&A due to the first real case of “Decentralized M&A”: the merger of NuCypher and Keep Network.

Why is this the first real case? There have been dozens of ICO/token-funded teams that participated in M&A activity in past years, but not a single deal could be characterized as being decentralized. The NuCypher-Keep breaks this pattern for three reasons:

- Functional Networks: Both NuCypher and Keep are active protocols, each with working nodes and meaningful market value (~$100M each)

- “Synergies”: The NuCypher protocol brings a secure and decentralized infrastructure (>2k nodes) while Keep brings a working application (tBTC)

- Distinct communities: While the two protocols have some overlap in participants and token holders, each project had distinct founders, development teams, DAOs and governance procedures.

This specific merger has not concluded yet and mechanism design for the merged protocol could still prove tough. Nonetheless, the merger has gained initial unanimous support from both communities. NuCypher and Keep are establishing important first steps that many protocols will follow.

Full Report

Download the full report to get a detailed breakdown of each of these topics and data-driven forecasts.

Enter email to receive a link to download the survey results

CRYPTO’S SECOND WAVE: A POINT BREAK?

Wednesday, February 3, 2021“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

With this headline in 2009, Satoshi kicked off a conversation about the nature of money. Because few people – ourselves included – have the mental fortitude to dig into money supply dynamics, the impact of crypto is distilled to one primary signal: BTC/USD.

The bailout of a few mortgage-punting banks sparked crypto’s first wave, which saw its peak in 2017, with Bitcoin reaching $20k before plummeting >50% in a matter of weeks. What many had hoped to be the perfect pipeline ended up being a scammer-filled wipeout.

The COVID-19 pandemic and government-led monetary interventions have acted as a point break revealing crypto’s second wave.

With Bitcoin topping 2017s all-time-highs decisively, we want to answer some key questions:

- Which narratives are helping crypto sustain its momentum?

- Which new players are riding this wave?

- How should investors be aiming to capture best conditions?

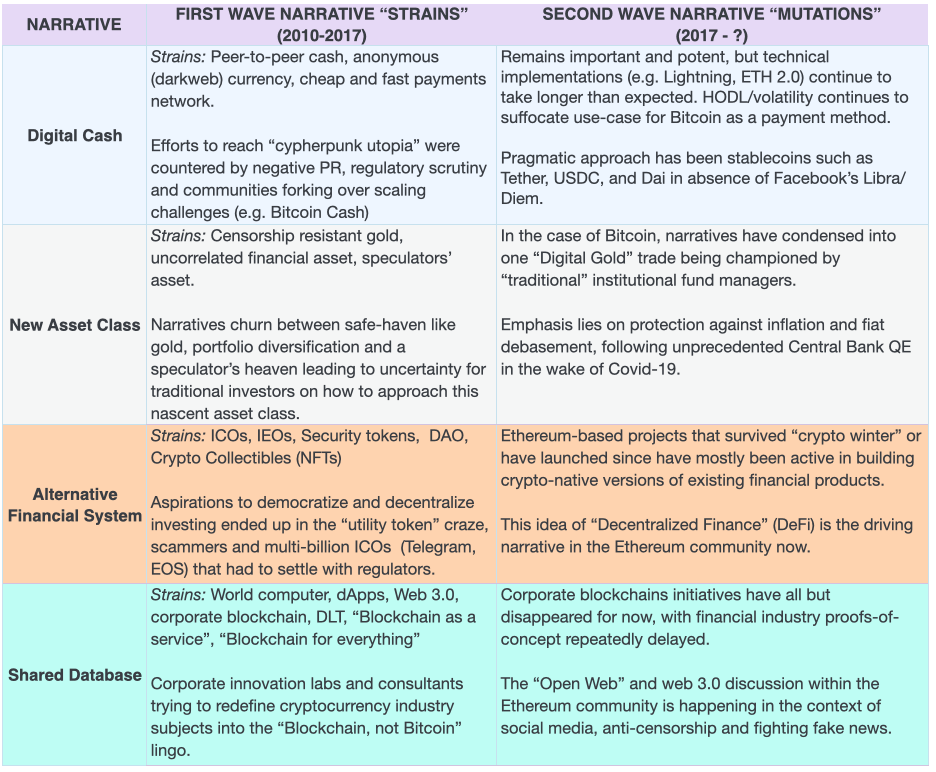

VIRAL NARRATIVES: WHAT DOES CRYPTO REPRESENT?

Q: “This bitcoin thing — is it a virus, a drug, or a religion?”

A: “What’s the difference?” – Naval Ravikant

In digital labs, cypherpunks experimented until they finally merged money with their utopia of “code is law”. Ever since Bitcoin’s whitepaper release into the wild, crypto advocates and critics have been challenging one another, causing an ecosystem layered with narratives.

Ironically, crypto’s first wave ended because there was little narrative consensus. Too many mutations – and forks – took place, culminating in the 2017 hype of there being a blockchain to tackle any and every problem.

Living through a pandemic is making us ask – what can we vaccinate against?

While crypto narratives spread like a virus, the narratives that are strongest in crypto’s second wave, and have caused a resurgence to new all time highs are the ones built around immunity:

- Digital Gold (Bitcoin): Immunity against inflation, and fiat-debasement because of QE

- Decentralized Finance (Ethereum): Immunity against asset seizures, trading halts (vis-a-vis Robinhood and wallstreetbets), etc.

If financial risk management is an exercise in choosing the best mediums for protection, then crypto is a drug that can give meaningful protection to inflation and give people upside to a new financial system.

So is crypto a virus, a drug, or a religion? What’s the difference…

NEW CARRIERS: MACRO FUND AND FINTECH SURFERS

“I am not a hard-money nor a crypto nut” – Paul Tudor Jones

Soundbytes by macro fund legends on CNBC, $310k BTC predictions by Citi, and the Financial Times ceding ground, are signs that the second wave of crypto is being amplified by a new group – “the institutions”.

On the buy-side of the institutional spectrum are macro funds like Paul Tudor Jones, long-only funds, and a handful of pioneering company treasuries. On the sell-side, fintech companies such as Paypal and Square offer crypto and invest in the ecosystem while the Goldmans and JPMs are busy assembling their 5-layer “Digital Assets” teams (emphasis on omission of “crypto”).

*Bitcoin buy-data from Casebitcoin.com

While the volumes bought by the “institutions” are still just a rounding error, the prospect of a 10x – or dare we say – 100x return on investment and future bragging rights, brings participants with legitimacy and best practices to a market infatuated by anon accounts and coins named after dog-memes.

CROWDED CRYPTO TRADES*

“If you want the ultimate, you’ve got to be willing to pay the ultimate price.” – Bodhi (Point Break)

Good trades, like good waves, get crowded. The mantra of don’t buy what you don’t understand is more important than ever. The big wave surfers of institutional crypto, ride the pipeline of Bitcoin’s momentum, hedge their initial investments with the right tools and reap the gains. The n00b bodyboarders see Bitcoin at $40k, think it’s “too expensive”, pile in Ripple, and get crushed.

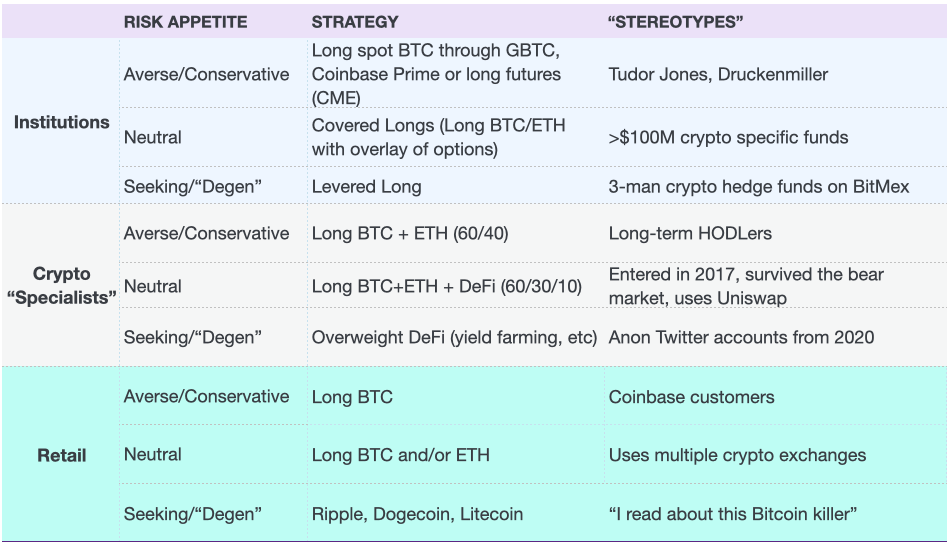

However, stupidity and recklessness are not beholden to retail investors. We’ve taken the liberty to simplify the consensus trades by investor type below:

BEWARE THE REEF OF REGULATORS

“(Bitcoin) is a highly speculative asset, which has conducted some funny business” – Christine Lagarde

While Lagarde and heads of state only seem to care about the “dangers” of crypto when the price goes parabolic, the actual deeds by regulators seem more pragmatic and show awareness of everything happening in the crypto space.

Nonetheless, the following topics are likely to fill the timesheets of regulators, lobbyists and crypto-lawyers busy for the foreseeable future:

- Stablecoin regulation

- KYC of non-custodial wallets

- Limits on crypto derivatives trading

- ICO-style crackdown on DeFi tokens

- The elusive Bitcoin ETF (wen?)

With the influx of institutional players, the discussions could become very different from the ones in the previous cycle. Will regulators be the gnarly reef crushing the industry’s momentum, or will they eventually will push crypto’s second wave even higher?

Hang loose, HODLers, we’ll find out soon enough!

The TokenData Team

Crypto M&A: 1H20 Update

Wednesday, August 19, 2020What follows is a short summary of our research report about M&A activity in the cryptocurrency space. The full version can be downloaded for free:

Enter email to receive a link to download the survey results

1H20 Deal Flow

42 acquisitions involving cryptocurrency and blockchain companies have taken place in the first half of 2020. At the start of the year, our industry survey had a majority of participants forecast a significant pick-up during 2020. While deal activity in Q1 was promising, we’ve seen a pull-back in Q2. Nonetheless, activity is on track to match 2019 despite the Covid-19 crisis.

We estimate that deal value in the first half of 2020 has already matched 2019. The main reason for this increase is the re-emergence of large nine-figure transactions, mostly absent in 2019. The best example is the $300-400M acquisition of CoinMarketCap by Binance

Crypto Exchanges & Decentralized M&A

Exchanges and other trading-related companies were the most active strategic buyers in the first half of 2020.

Moreover, while we have not seen an actual case of “Decentralized M&A” yet, there have been deals involving protocols and ICO-funded teams.

Download the full report for an in-depth analysis on these topics.

Enter email to receive a link to download the survey results

State of Crypto M&A: Update & Survey

Wednesday, March 4, 2020Following up on our landmark M&A research piece for 2019 we provide a few insights on what’s been happening so far this year.

M&A slowdown

There has been a slowdown in Crypto M&A activity, contrasting our initial expectations and those of industry executives and investors. Nonetheless there have been a few notable deals:

- Circle sold its retail business to crypto broker Voyager continuing its divestment program

- Bakkt bought loyalty solutions company Bridge2 which is remarkable since Bridge2 is a non-crypto company

- Kraken bought Australian exchange Bit Trade in another consolidation power move by the high profile exchange

- TRON acquired DLive (video streaming) and Steemit (blockchain social network)

Key industry executive M&A Survey

Over the past month we have collected the views of key industry executives and investors and have summarized the findings in a new report that you can download on our research portal:

Enter email to receive a link to download the survey results

- 2020 will be the year of M&A: A majority of all survey respondents expects 2020 M&A activity to outpace 2019.

- >75% of founders were involved in M&A discussions: We were surprised to see that such a large majority of founders were active on the M&A front – both as targets and buyers. However, most of these discussions didn’t end up in actual deal activity. This is from A-list entities, and we can only guess how much is going on at the long-tail of crypto startups.

- Deals “bounce” because of many reasons that are not about price: Whereas analysts will often focus on the price of a deal, founders have reportedly turned down offers due to non-economic reasons such as branding and the need to relocate their business.

- What data room? The “wild west” image of many crypto startups is visible in some deals not closing due to targets being unable to pass basic due diligence procedures.

- Will the Goldman Sachs of Crypto please stand up? Most deal activity and advisory is done in-house, or by executes of the large incumbent companies. When asked about influential dealmakers, survey respondents failed to mention an independent crypto M&A dealmaker.

- When Decentralized M&A: 1 in 5 respondents thought that there will never be a case of Decentralized M&A (e.g. protocol takeover, independent of centralized party)

More in-depth updates will be available in the next edition of our State of Crypto M&A report which is due later this month.

Crypto ≠ risk pandemic vaccine

Wednesday, March 4, 2020Choosing between selling n95 face masks in exchange for stablecoin and publishing data driven insights about crypto, we clearly prefer the latter. In this update we shed light on exchanges (Deribit and FTX) looking to set the benchmark for crypto vol trading and carve a niche ahead of the incumbents.

Wars, pandemics, and crypto volatility

If you’re active in crypto like us, you are inclined to think about financial markets, “black swan” events, and exponential events. Nassim Nicholas Taleb and Naval are our saviors. The first quarter of this new decade has given us plenty of geopolitical events that have caused many crypto pundits to salivate and want their cake and eat it.

- “Rooting for WW3 and BTC all-time-high” – The assassination of an Iranian general by the US in January and subsequent tension in geopolitics was paired with an uptick in price and plenty of “BTC is a safe haven” comments from your crypto twitter pundits.

- “Party like it’s 1999” – Bitcoin crossed 10k in February while equities, tech stocks and risk-assets rallying in dot-com fashion. Familiar memes like “This time it’s different”, “Institutions are coming” and “This will be the last time Bitcoin will cross 10k” popped up everywhere.

- “Want a slice of lime with it?” – While the crypto community has done an amazing job analyzing and debunking stories about corona/n-covid 19 most of us have been silent about Bitcoin prices falling in line with risk-on assets while gold and treasuries have rallied. Until mask manufacturers start accepting bitcoin as a means for priority delivery or all of Asia refuses to touch cash, crypto as pandemic-hedge seems far fetched to us.

This market volatility has benefited the incumbent (spot) trading venues. Coinbase and Binance have seen volumes bounce up in the first two months of the year. However, the more impressive growth comes from the derivatives exchanges that focus on crypto volatility products.

2 phases of volatility trading

Taking a simple approach, we distinguish between two phases of crypto volatility trading:

- In phase 1 of crypto volatility trading, exchanges offer the ability to trade on margin and leverage for people who want to get even more exposure to the volatility of the underlying cryptocurrencies. Bitmex is the best example of leveraged crypto trading for retail punters and CME and Bakkt set the standard for “old fashioned” financial institutions wanting a little go at Bitcoin through cleared futures.

- In phase 2 of crypto volatility trading, exchanges offer instruments that allow volatility itself to be traded through options, straddles and volatility indexes.

Two exchanges have emerged as the pioneers of phase 2 through significant growth and innovative product offerings: Deribit and FTX

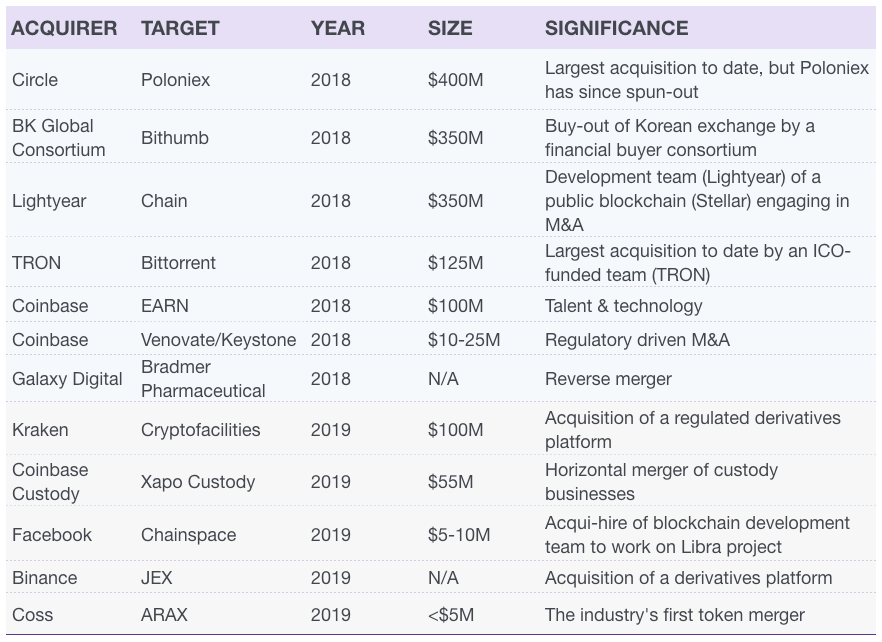

Read the full articleCrypto M&A: Barbarians on the Blockchain

Sunday, November 24, 2019Crypto M&A – A comprehensive review

Crypto M&A is alive and kicking. 350 acquisitions involving cryptocurrency and blockchain companies have taken place since 2013. However, beyond anecdotes, press releases and high level summaries, there haven’t been any thorough or forward-looking analyses, until now.

What follows is a condensed version of a full research report that can be downloaded for free:

Enter email to receive a link to download the full report

Deal Activity

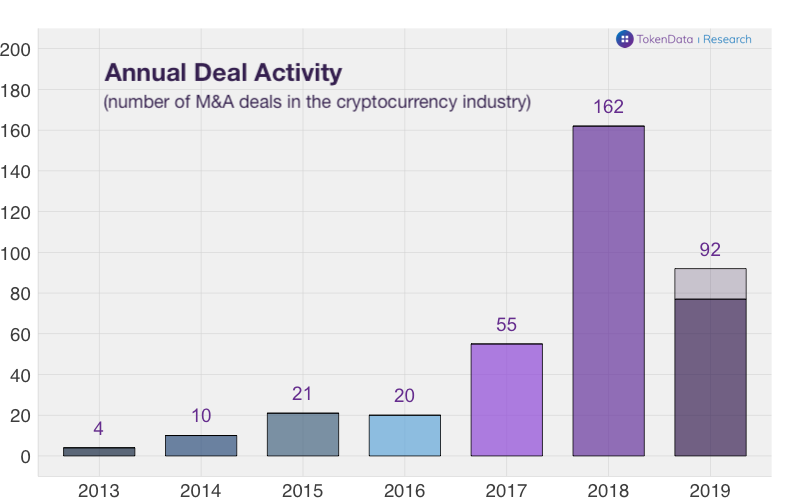

350 acquisitions involving cryptocurrency and blockchain companies have taken place since 2013. M&A activity peaked in 2018 with more than 160 deals, and we estimate 90-100 deals for 2019.

M&A activity is volatile and seems positively correlated to crypto prices and industry sentiment. Monthly activity peaked in early 2018 as prices and industry attention soared.

Deal Value

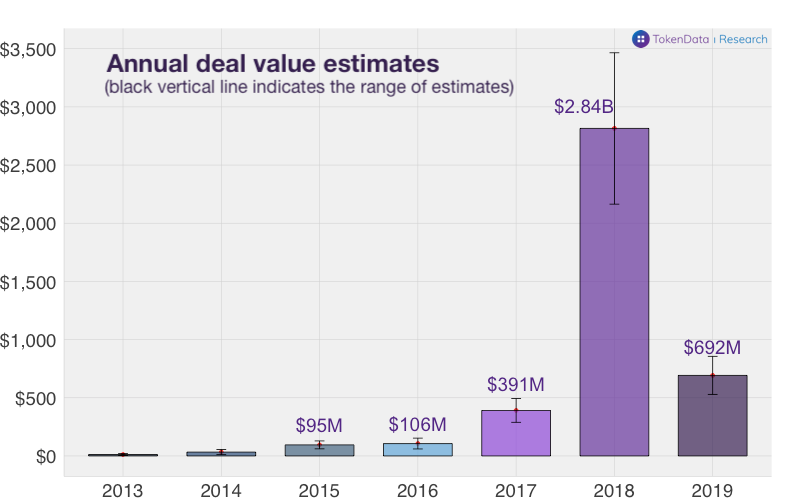

We estimate total deal value at $4 Billion since 2013, with $2.8B of M&A activity in 2018 and $700M in 2019. These figures might sound impressive, but are small compared to the total network valuation of cryptocurrency networks ($200B+). This makes sense given the early stage of this industry: most companies are less than 5 years old and a significant IPO seems years away.

A closer look at marquee transactions and interesting deals shows only one $100M+ transaction in 2019, versus five in 2018. However, 2019 has seen interesting acquisitions such as the acquisitions by Facebook for its Libra project, the consolidation in the crypto custody space (Coinbase-Xapo custody) and the first token merger.

Read the full articleToken Buybacks: Design or Despair?

Friday, November 9, 2018Similar to stock buybacks, token buybacks involve a cryptocurrency project buying back its tokens from existing holders. We’ve come across a number of examples and have divided the token buybacks into three categories:

Buybacks Instead of Dividends

Some projects have explicitly mentioned buybacks as a core feature of their business and token economics. The best examples are the successful Asian crypto exchanges (Binance, Huobi, Kucoin) and their respective exchange tokens (BNB, HT, KCS).

These exchange tokens have three functions:

- Medium of Exchange / Trading Fee

Token holders can choose to pay their trading fees in tokens. - Discount Mechanism*

If token holders pay the trading fees in tokens, they receive a discount on the fees. - Buyback Rights / Periodic Payouts

The exchanges pledge to use a percentage of revenues/profits for buybacks on a regular basis.

Given the large volumes and revenues generated by these exchanges, the token buybacks have been substantial with Binance and Huobi returning more than $30M back to token holders.

Projects with pledged buybacks

| Project | Sector | BuyBacks | Source | Post-BuyBack | Size |

|---|---|---|---|---|---|

| Exchange | Quarterly | 20% of profits | Burn | ~ $30M | |

| Exchange | Quarterly | 20% of Revenues | Locked in Reserve | ~ $35M | |

| Exchange | Quarterly | 10% of Profits | Burn | ~ $1M | |

| Asset mgmt | Continuous | Varies | Burn | N/A |

After the buyback, the tokens are burned by a smart contract and/or deposited into a wallet with no private key. As a result, the profits used for the buyback should – theoretically speaking – be fully captured by token holders. In the words of Vitalik – the token’s value is “backed by the future expected value of upcoming fees spent inside the system”.

Or, put simply: the tokens are similar to “traditional” equity because the buybacks ensure that token holders receive (part) of the profits created by the project – just like dividends paid to shareholders**.

Buybacks to Correct Token Allocation

One of the biggest challenges of cryptocurrency projects and ICOs is the initial token allocation. Many projects reserve a fixed amount of tokens to incentivize future partnerships, developers etc. A potential outcome of this “one shot allocation” challenge is that there aren’t enough tokens to hand out a few months/years down the line.

That’s why a handful of projects have started buying back tokens in the secondary market to mitigate this issue. Some examples:

Aragon: The well known DAO project Aragon has been buying its token on a regular basis and has published quarterly reports and guidelines.

Pundi X: The crypto payments and point of sale project Pundi X reported buying ~2000 ETH worth of tokens in June to be put into a partnership reserve.

ICOs are dead – long live the ICO

Wednesday, November 7, 2018 Token and ICO fundraising continued a steep decline in July 2018. 40 ICOs and (private) token sales raised a total of $417M – down from $585 Million in June and $2 Billion in May. This is the lowest monthly amount we’ve measured since May 2017.

Token and ICO fundraising continued a steep decline in July 2018. 40 ICOs and (private) token sales raised a total of $417M – down from $585 Million in June and $2 Billion in May. This is the lowest monthly amount we’ve measured since May 2017.

A closer look at the data reveals the following:

- No “mega” ICOs: While the summer of 2017 was characterized by the first “mega” ICOs (Tezos, Status, Bancor), the summer of 2018 is characterized by their absence. There have not been any sales that have verifiably raised more than $100 million in June or July 2018.

- U.S. teams are absent in public sales: Only a handful of cryptocurrency teams in the U.S. are still raising funds through public ICOs. Most – if not all – activity has shifted to private sales and traditional equity rounds. We’re not seeing this shift in Europe…yet..

- Tokens underperform: Token prices have cratered in the past months – some dropping more than 80% (more on that below). As shown in the table below, the median return of all ICO issued tokens is now -20% (0.8x). Moreover, ICO-issued tokens not only underperform relative to their ICO sale price but also to Bitcoin and Ether.

The “worst cohort” of tokens are those issued in the first half of 2018 – especially those issued by ICOs that took place at the peak of the cryptocurrency boom. For the 100 tokens issued in Q1 2018 the median return is -60% (0.40x), compared to “just” -30% (or 0.7x) for a portfolio consisting of Bitcoin.

Median Returns by ICO Date

| ICO Date | Nr of ICOs | Token | ETH | BTC |

|---|---|---|---|---|

| 2017 Q1 | 6 | 8.9 x | 33.6 x | 6.9 x |

| 2017 Q2 | 42 | 1.8 x | 1.8 x | 3.0 x |

| 2017 Q3 | 61 | 1.0 x | 1.8 x | 2.0 x |

| 2017 Q4 | 84 | 1.1 x | 1.3 x | 0.9 x |

| 2018 Q1 | 100 | 0.4 x | 0.5 x | 0.7 x |

| 2018 Q2 | 34 | 0.6 x | 0.8 x | 0.9 x |

| _ | 327 | 0.8 x | 1.1 x | 1.0 x |

It’s safe to say that the correction in cryptocurrency prices and increased regulatory attention have finally had an effect on the ICO market. Although we’re hesitant to pronounce “the death of the ICO” we believe that the corrections in both new capital and trading activity are well-needed and long overdue.

The Decay of Token Prices

In addition to calculating the returns by ICO date, we’ve done a full historical analysis of more than 300 ICOs that have taken place since January 2017. As shown in the graph above, the individual tokens (in red, left axis) traded as high as 200-250 times their original ICO price during December 2017 and January 2018.

But – as cryptocurrency markets have corrected – the combined value of these 300 tokens has dropped by more than 80% since the peak in Q1 2018. A hypothetical cryptocurrency portfolio consisting of all 300 tokens would now be worth ~$600 versus $3500 at the peak (in purple and right axis). While this $600 is still double the original investment of $300 (black line), we highly doubt that we’ll see the levels of Q1 2018 soon or ever again…

*If you have questions about this analysis or any data-related queries, reach out to our research team ([email protected])!

**Methodology is as follows

- ICO Selection: Select all ICOs which raised at least $1 million and calculate the token price during the ICO

- Token Selection: Select only tokens which are publicly traded and have daily trading data available

- Individual Token Values: (red lines) Rebase all tokens to $1 investments at the ICO end-date and calculate return multiples

- Cumulative Token Value (purple line): Calculate the sum of all Individual Token Values Investment (black line): Calculate the sum of all $1 investments into ICOs over time.

Mega-ICO-saur sale extinction?

Wednesday, August 1, 2018July had the lowest ICO activity in more than a year

Token and ICO fundraising continued a steep decline in July. 40 ICOs and (private) token sales raised a total of $417M – down from $585 Million in June and $2 Billion in May. This is the lowest monthly amount we’ve measured since May 2017.

A closer look at the data reveals the following:

- No “mega” ICOs: While the summer of 2017 was characterized by the first “mega” ICOs (Tezos, Status, Bancor), the summer of 2018 is characterized by their absence. There have not been any sales that have verifiably raised more than $100 million in June or July 2018.

- U.S. teams are absent in public sales: Only a handful of cryptocurrency teams in the U.S. are still raising funds through public ICOs. Most – if not all – activity has shifted to private sales and traditional equity rounds. We’re not seeing this shift in Europe… yet…

- Tokens underperform: Token prices have cratered in the past months – some dropping more than 80% (more on that below). As shown in the table below, the median return of all ICO issued tokens is now -20% (0.8x). Moreover, ICO-issued tokens not only underperform relative to their ICO sale price but also to Bitcoin and Ether.

The “worst cohort” of tokens are those issued in the first half of 2018 – especially those issued by ICOs that took place at the peak of the cryptocurrency boom. For the 100 tokens issued in Q1 2018 the median return is -60% (0.40x), compared to “just” -30% (or 0.7x) for a portfolio consisting of Bitcoin.

It’s safe to say that the correction in cryptocurrency prices and increased regulatory attention have finally had an effect on the ICO market. Although we’re hesitant to pronounce “the death of the ICO” we believe that the corrections in both new capital and trading activity are well-needed and long overdue.

Cheers,

Ricky from TokenData

The Decay of Token Prices

In addition to calculating the returns by ICO date, we’ve done a full historical analysis of more than 300 ICOs that have taken place since January 2017. As shown in the graph above, the individual tokens (in red, left axis) traded as high as 200-250 times their original ICO price during December 2017 and January 2018.

But – as cryptocurrency markets have corrected – the combined value of these 300 tokens has dropped by more than 80% since the peak in Q1 2018. A hypothetical cryptocurrency portfolio consisting of all 300 tokens would now be worth ~$600 versus $3500 at the peak (in purple and right axis). While this $600 is still double the original investment of $300 (black line), we highly doubt that we’ll see the levels of Q1 2018 soon or ever again….

A high resolution PDF version of graph can be downloaded here.

*If you have questions about this analysis or any data-related queries, reach out to our research team ([email protected])!

**Methodology is as follows

- ICO Selection: Select all ICOs which raised at least $1 million and calculate the token price during the ICO

- Token Selection: Select only tokens which are publicly traded and have daily trading data available

- Individual Token Values: (red lines) Rebase all tokens to $1 investments at the ICO end-date and calculate return multiples

- Cumulative Token Value (purple line): Calculate the sum of all Individual Token Values

- Investment (black line): Calculate the sum of all $1 investments into ICOs over time

** Returns are calculated assuming that someone invested 1 USD in every ICO and put 1 USD in ETH and BTC at the same time in separate portfolios. There is no rebalancing or weighting.