The MITation game — Q&A with Enigma

Tuesday, August 29, 2017Interview with the team behind Enigma about building a community, token sale best practices and how to deal with the aftermath of a security breach.

Intro

Who? : Enigma (https://www.enigma.co/)

What? : Decentralized data marketplace (Enigma) and platform to create cryptocurrency trading strategies (Enigma Catalyst)

Where?: https://token.enigma.co/

When? : September 11th 2017

Why interview? (Official reason): Because at TokenData.io we’re as obsessed with data and analytics as the Enigma team, and because the team has been transparent about how it handled a security breach.

Why interview? (Unofficial reason): Because all members of TokenData applied for MIT but were denied admission…

Part 1: The full Enigma download

Q: What are Enigma and Enigma Catalyst?

A: Enigma is building a decentralized, open, secure data marketplace using ENG, our native token. Right now the long tail of data is not being effectively captured by major data aggregators. Meanwhile other data is being hoarded and exploited by large corporations. We want to change how data is shared, aggregated and monetized in a way that maximizes collaboration.

Catalyst is Enigma’s first product built on top of this marketplace. Catalyst matches financial data consumers (quantitative traders and investors) who want to create smarter crypto investment strategies with financial data curators who license their data to the Catalyst community. The platform also provides backtesting and research tools for traders to create strategies, greatly reducing the typical time and expense of strategy creation.

Q: Rumors are that Enigma is run by a group of MIT wunderkinds who could make Will Hunting’s math look like a 5-year old’s table-scratch. Can you shed some light on the history of your team?

A: Our team has all studied at MIT. We are entrepreneurs with years of experience in the fields of finance, data science, technology, trading, and FinTech. Our co-founders are Guy Zyskind and Can Kisagun, who met at MIT.

Our advisors include Prof. Sandy Pentland of the MIT Media Lab, Justin Lent of Quantopian, Bill Barhydt of Abra, and many others with decades of experience in relevant fields. We believe our team and advisors are one of the strongest aspects of our project and will allow us to achieve our vision for the future of data.

Q: There are at least 15,061 PhD students writing their dissertations on blockchain projects and analyzing the footnotes of Satoshi’s original whitepaper. How did Enigma evolve from an academic research project at MIT to its current form?

A: A decentralized data marketplace was one of the first things proposed in our whitepaper in 2015. The ethos of the MIT Media Lab is “Deploy or Die” — meaning we are not content to keep our interest purely academic. Getting working products into the hands of our community has always been our goal. As the space has evolved, the time is finally right for products like Catalyst and Enigma to thrive.

Part 2: If you build it, they will come

“We believe creating adoption around a usable product is the right approach, and one that is often overlooked in the crypto space.”

Q: Catalyst is designed to be the application layer on top of the Enigma decentralized database protocol. Are you planning to launch Catalyst before Enigma’s database protocol is ready? If so, how do you foresee a transition as the underlying protocol gets ready to launch.

A: Yes. We believe creating adoption around a usable product is the right approach, and one that is often overlooked in the crypto space. The first iteration of Catalyst would include a centralized data marketplace for crypto data, where we will host our own data sets, as well as those contributed by members of the community, in return for ENG bounties. The transition to the data marketplace protocol would be gradual.

At first, we will release a client that allows data curators to host their data sets on their own servers, but data subscription would still be done centrally through our servers. Later on, after a sufficient period of testing, we will bootstrap the decentralized data marketplace protocol with all the existing data-sets to date, at which point, Enigma would become just another node in the network.

Part 3: The comps

Q: According to our dataset, there are a number of projects out there who are launching token sales to fund either a decentralized database and/or algorithmic cryptocurrency trading platforms. What differentiates Enigma?

A: The Enigma team has been researching the idea of a data marketplace for several years now, with the original Enigma whitepaper being one of the most downloaded and cited papers in the blockchain space. Very few of the current projects (if any) that work around decentralized computation and storage have worked through the required technical hurdles. In that sense, our team is well suited to address that challenge. In terms of an algorithmic cryptocurrency trading platform, our alpha has already seen thousands of sign ups in the few weeks since its launch. Our biggest strength may be the growth in our community. As a platform, we rely on having an engaged community to succeed and grow. With 9000+ users already in our Slack channel, we’re confident in our strong momentum.

Q: How does Enigma Catalyst compare to Numerai, another high-profile blockchain platform which incentivizes cryptocurrency investors to develop and implement algorithmic cryptocurrency trading strategies. Is there room for both projects and tokens?

A: The main difference is that Numerai is a fund, while we are a platform. Numerai uses predictions from the community to make their own investments. We give community the tools to allow our users make their investments and hence capture their own upside. Also, the long-term vision of Enigma is much broader than that of Numerai.

Part 4: Token Sale Best Practices

On the token sale front, we like what 0x and Civic did — ensuring access to the community, as well as a large distribution of tokens.”

Q: Your token sale is planned for Sep 11. Can you describe the team’s vesting rights and how you plan to get a wide distribution of token holders.

A: The team’s ENG tokens vest over multiple years, with all of the team committed to holding their tokens through the first year. Since we are a platform that depends on its users to be successful, we are committed to a broad crowd sale with a focus on our core community. We also have a significant portion of our created ENG tokens allocated to our community through incentives.

Q: You recently announced and started the Catalyst Contests in which people can test strategies and earn ENG tokens. Can you tell us more about some of the results you’ve seen so far and the feedback from early users?

A: Catalyst Contests are our newest creation, with our first content currently running right now, so it’s a bit early to remark on results. The best strategies are eligible to win ENG tokens for beating the crypto markets. So far our early users have been essential in helping us refine the Catalyst product and make more accessible to our community. We’re working closely with professional quants to ensure we’re building a powerful product that is still usable by anyone.

Q: What are cryptocurrency projects/ICOs/token sales that Enigma looks at as a good example for running a project and token sale?

A: On the token sale front, we like what 0x and Civic did — ensuring access to the community, as well as a large distribution of tokens. We believe communities are what wins the game. On the project side, we like Ethereum and Filecoin — both have done a tremendous job in popularizing complicated tech and making it accessible for developers.

Q: What is your view on the recent SEC ruling, and if/how it affects your project and more specifically, the ENG token and the statement that “Catalyst allows anyone to build their own crypto hedge fund.”

A: According to the legal advice from our excellent lawyers, ENG is a utility token and it does not constitute a security. We have complied and intend to comply with all guidance from regulatory bodies. For more information refer to our lawyer Marco Santori’s tweets on utility tokens.

Part 5: Phishing Attack Aftermath

“First and foremost, always educate your community.”

Q: Last Sunday, there was a security breach of the Enigma website and Slack channel that resulted in a phishing attack and fake pre-sale announcement. How long did it take the team to notice that something was wrong, and what were your first actions?

A: The Slack community first brought the attack to our attention almost immediately. Our first action was to take the website down and change all passwords to any critical systems. That is likely what mitigated most of the attack, as at that point people in the community were aware that this was a phishing attempt. All e-mails were sent from a fake account that didn’t belong to the company. Our community was instrumental in handling Slack and warning people of the phishing attack, and we are grateful for their help in containing the impact.

Q: What actions and security measures have you taken in response to the hack?

A: Enigma announced that it has taken responsibility and will restore funds to everyone that lost money in this recent scam attempt after the token sale concludes. We are deeply sorry for the pain experienced by those who lost funds to the scam attempt, and we want to make sure that no one in our community that was a victim to this well-coordinated phishing attack is financially hurt. We’re very thankful that our community has stood by us and continues to support our project.

Here are the announced measures we’ve taken:

- Strong, different, random passwords for each account — whether held by an employee or official communication channels for the company

- 2FA for all such accounts

- Weekly password rotation, and daily rotation in the week leading to the token sale

- Proper access control management and compartmentalization

We are taking additional security steps that we are not making public at this time. We’re also working with law enforcement, exchanges, token sale companies, and our community to continue to pursue the lost funds and the scammers. We hope to have more announcements on this matter soon.

Q: Given the amount of token sales that are slated to take place after yours, how can other token sales learn from your mistakes and what would you recommend them to do?

A: First and foremost, always educate your community. We made multiple announcements prior to the scam attempt that no money should be sent to anyone for any reason prior to our crowdsale date, and we provided guidance for identifying phishing attempts. Token sales should take every security precaution from day 1, including those we mentioned here, and you should ask that your community do the same. We’re currently working with other token sales, both previous and upcoming, to establish clear best practices and share our learnings.

— — — —

Special thanks to Tor Bair from the Enigma team for co-ordinating the interview. Any comments & questions are welcome at [email protected].

DISCLAIMER: The interview with Enigma is not sponsored content and TokenData.io is not getting compensated by the Enigma team in any form whatsoever. This interview is for informational purposes only and does not constitute any solicitation or endorsement of investment. Any token purchases you make are at your own risk and discretion. The contents of this interview are the property of TokenData.io — All rights reserved.

[addtoany]The Crypto Startup with No ICO

Wednesday, August 23, 2017Why blockchain startup Balance chooses to raise $1M through equity crowdfunding instead of tenfold in an ICO

Last week, the TokenData.io team was sent an e-mail to list the ICO for a personal finance application called Balance. When we visited the site, we found out that their “ICO” was wordplay for a ‘traditional’ equity crowdfunding campaign. Always appreciative of puns and slight sarcasm, we did some further research and found out that Balance was founded by cryptogeek-meets-kitesurfer-meets-British-bloke Richard Burton. This led us to DM him one simple message: “You’re a crypto die-hard, and in a world in which every single crypto related startup seeks funding through an ICO, why not you?”

What followed was a much longer discussion which we’ve transcribed below:

Q: What is your background in cryptocurrencies?

A: Three years ago I was jogging around San Francisco listening to podcasts about Bitcoin and I heard Vitalik talk about Ethereum. It sounded meaningfully different to all of the other alt-coins that had forked Bitcoin and I remembered the name of the project. Later that week, I spoke to a fellow kitesurfer Bill Tai and he told me to look into Ethereum. Then a few days later Gavin Wood, the CTO of Ethereum, walked into our dingy hacker house and talked about building a global super computer. My mind was primed for the ideas he was sharing and, I asked him if I could help our by designing things for the team. He introduced me to Vitalik and we worked together in England for about a month on some concepts for a distributed app store and an Ethereum browser. These ideas were used to help Gavin pitch Ethereum to people before the sale.

Q: Ok, enough about the early days of Ethereum, you make us feel manically depressed for not participating in the token sale despite our buddies telling us about it. Tell us more about Balance and how it’s related to cryptocurrencies and the blockchain sector.

A: Our first product, Balance, is a MacOS menubar app that connects to banks and shows your personal finances. Balance began as a side project a couple of years ago while I was interviewing for jobs in the FinTech industry. I showed an early version to my friends Christian and Ben and we spent the next year building out the app and we launched it in February 2017. As ETH went up 100x, we ended up doing some design work for the Filecoin team and Juan Benet told us about a future where protocols ran everything. We started to realise that Balance could become a company that builds products not only for ‘traditional’ financial institutions and fiat money, but could also serve as a bridge to digital currencies.

Our second product, Balance Open, connects to digital currency exchanges through their APIs. Our plan is to just have one version of Balance that works with all of the world’s currencies, digital currencies and blockchain tokens. We want people to be able to see all of their traditional and digital assets side by side. One single interface for both banking and blockchain data. One place for all balances.

Q: Time for the money question: In an era of tokens and ICOs, and as someone who’s been involved in two significant token sales, what made you choose a traditional equity crowdfunding campaign instead of potentially raising multiples of that in an ICO?!?

A: Our team has worked and participated in the best and the biggest ICOs: Ethereum and Filecoin. Ethereum raised around $17 million and delivered a multi billion dollar protocol. I think that speaks to the power of a network-based project. Balance is not building a protocol, we are building a product.

Moreover, the huge sums of capital that are flowing into the average ICO are actually damaging to a young company. It shields the team from the market. The reason we are only raising a million dollars is because we have a lot to prove. If Balance fails to find product-market fit, we deserve to go out of business, we deserve to die, because we still need to make something people want.

I wish more of the people doing ICOs realized that you cannot defy gravity forever. If a sh*tcoin protocol raise goes well but you never ship useful software, you will fail. You will be forgotten. If you steal that money and disappear to another jurisdiction, you will be noted. You will be digitally hunted by a well financed group of crypto-sherriffs who see it as their duty to police this space. It is already happening. There is a huge cost to being dishonest in the crypto community and there is a huge benefit to being trustworthy.

Q: Do you see a place for a token sale later in your company’s life? In other words, what’s your view on ICOs as post-seed startup funding?

A: I am paying close attention to teams who are putting equity/shares on the blockchain. The fancy wording for this is the “securitization” of tokens. For example: the company behind the Lykke exchange issued equity tokens.

We would love to issue “BAL” tokens for Balance that represented shares in the company, but only when we have a underlying business that warrants a larger fundraise and when the regulatory environment is more clear than it is right now. It would effectively be a mini-IPO and fall squarely within the remit of the Securities and Exchange Commission. There are so many benefits and risks to this approach. On the positive side, we could easily remunerate team members and outside contributors with shares in the company. The risk is that lots of sh&tty companies start issuing equity tokens and regular investors get scammed.

Q: What are your thoughts and concerns about the current crypto landscape?

A: There are two kinds of people flooding into this space: Creators and extractors. The creators are the engineers, designers, cryptographers, academics, marketers and operations people. They want to help build the open financial system. I love all of them. The extractors are the scammers, skimmers, liars, idiots, and greedy people. They want to enrich themselves and steal money from others.

I find that meetups and conferences are emotional rollercoasters of wonder and disgust. You meet the most inspiring minds in the world who are trying to solve the major issues in the chain space. Then the next person will be some scum-of-the-earth scam artist just crawling through to sell their sh*tty coin. What I want people in the space to understand is this: there is a huge difference between holding a few cryptographic keys and actually making something people want. Just because you are rich does not mean that you are good.

Another area that I find most infuriating is the lack of great execution and design. So many cryptographers and early engineers completely dismiss the user interface as an easy part of the process — it is not.

If blockchain protocols are going to have any real world value, we need them to be easy for people and companies to actually use them. The products are just as important as the protocols. Great products take a lot of time and energy to get right. When the people pumping these sh*tty ICOs talk about “throwing together an iPhone app” I know they haven’t got a clue about product design. 99% of iPhone apps are relegated to the back of the phone and are never used. If you think your darling little uncapped ICO with a sh*tload of hype is going to be front and center for people in their daily lives, you are wrong.

Blockchains are built on digital trust and great people. I wish there were more trustworthy people in the space. The ICO world has a lot of capital, cryptography and hype. What it lacks is a lot of great execution, design, integrity and genuinely useful software. That is what worries me.

[addtoany]The ICO Rat Pack — Gambling Tokens

Tuesday, August 22, 2017We launched TokenData a month ago. Since then we’ve added 200+ sales (525 total), 50 trading stats (105 total), and had one ICO team launch an anti-TokenData campaign on Twitter (cheers for boosting our social presence Populous Platform!). A sincere thanks to all who have checked out tokendata.io, signed up for our newsletter, and sent us constructive feedback. Much of our commentary & updates are predicated on the latter, so keep the suggestions comin’!

Decentralized Dutch Courage

While we love talking about crypto more than playing FIFA (if only just), nothing makes us happier than free drinks and appetizers. So, a couple of weeks ago, when we were invited for a cryptocurrency happy-hour, we were quick to turn off our Slack notifications, crawl out of our basement office, and venture to a bar filled with both experienced and newly-minted cryptocurrency folks.

Thirty minutes and some Dutch courage later, we middle-school danced our way over to a gaggle of crypto-lectuals. The topic of conversation: the merits of decentralization and ICOs to look out for. Yawwwwn. But — TD will be the first to admit — the majority of those in said discussion boast an IQ and private wallets at least 2x each of ours. And with all due respect to the discourse: is championing decentralization not prerequisite for admittance into such an affair?

We felt right at home expounding on protocol-upgrading tokens (Tezos, Polkadot) and fundamental infrastructure projects (Filecoin, Storj, 0x), but things got decidedly more interesting as the group’s focus abstracted up a layer in the fledgling web stack to decentralized applications (dApps). When nudged to proffer which category of dApps most piqued our interest, we instinctively blurted out, “uhh…the gambling ones”. We kid you not ladies and germs — you could hear a Satoshi drop.

The Good Ol’ Days?

The crypto-community loves to draw analogues between the early days of the interwebz and the advent of tokens / ICOs. We think big, talk fast and hope that HODL’s latest surge is our defining Netscape moment. If you’ve had sweaty palms, and sleepless nights since ’08 — we feel you. Proclivity for analogues, has led crypto luminaries to parallel TCP/IP, SMTP to protocol tokens and to cite Netscape, Linux, Amazon as the predominant harbingers of web application innovation in the internet’s spring. These technologies decidedly propelled the industry forward — no denying that. But there were also other less palatable forces at work — revolutionary applications that are whitewashed from water cooler and higher-educational conversations alike.

What people often (choose to?) forget is that the early days of internet growth was also fueled by mankind’s most enduring and conspicuous foibles: gambling and pornography. Entertaining though it may be, we’ll leave it to those with more chutzpah and less shame to delve into the intricacies of the latter. Sadly, The Legend Rooms, Lusts and XPlays of the world, will have to wait.

“History doesn’t repeat itself, but often rhymes”

Gambling sites made an early entrance as some of Web 1.0’s first applications. Back then, the World Wide Web was a relatively anonymous, decentralized and unregulated space. Sound familiar?

To jog your memory:

- Netscape — provider of the first truly dominant browser — founded? 1994.

- Microgaming — provider of the first real-money online casino — founded? You guessed it. 1994.

The advent of gambling dApps is oddly eerie in a time that most high profile ICOs are focused on the back-end of the decentralized internet stack. But there’s perhaps no more textbook case of history repeating itself. Quintessential case in point: Cyberspace Gambling, a 1997 opinion piece published by The Washington Post. Honestly a few quick ‘find-and-replaces’ could have written this article for us — and gotten the point across about as well.

Screw it — let’s take a shot on an excerpt…if just to prove a point (n.b., our replacements in bold, below)

Internet (DApp gambling), by contrast [to casinos], might remain a private vice with no government money in it — if anything, it might suck money from the state-funded lotteries. And that raises the question of how far Americans think government should go in regulating people’s conduct in the privacy of their homes (of the blockchain.)

This should rouse everyone, not just those involved with vicey ICOs. Why? Governors are rightfully concerned by the anonymity and decentralization that blockchain enables. Both reduce the ability to govern centrally, which is (allegedly) a governor’s primary function — it is right there in the job title, after all. But if there’s one thing governments like less than losing control, it’s losing the ability to take a slice of the pie. Other than the creation of a new “uncontrolled” and increasingly-accepted monetary unit (i.e., bitcoin) nothing screams more attention to this than the emergence of decentralized gambling platforms.

- Decentralize identity verification? Fine, no biggie.

- Anonymous transactions? Been there, z-cashed it.

- Erode Vegas’ profits, taxed & sanctioned online betting, and government-run lotteries? Oh sh*t, look out!

Gambling Boom: Not All Doom & Gloom

Over the past 20 years, as centralization and government regulation took place, consolidation took ahold of the internet, not only have we seen centralization of power in data (Google, FB) and marketplaces (Uber, Airbnb), but exactly the same in of gambling operators (Betfair, Pokerstars).

And, as much as we want to back the first decentralized Uber and Airbnb, gambling seems to be a patently simple, potent, and early use case for blockchain-based businesses:

- Credit risk: That stack of $100k in golden chips at the Bellagio and the $500 on your Betfair account are nothing more than IOUs and subject to counterparty credit risk. Much of this risk disappears in tokenized gambling applications, in which the user has full control (assuming he/she doesn’t lose the private key, which is a completely different and important topic)

- Accountability: Before online gambling regulations, there was (and still is?) no good mechanism for the user to tell whether the game was fair or rigged. Enter open-sourced gambling dApps. Want to check the odds on a game? Get the coding geek on your fantasy football team to check a gambling dApp’s Github repo.

- Anonymity: Are you a WSOP poker player relocating to Mexico because of whatever it is that you’re afraid off? Anonymous transactions on blockchain could be your virtual Cayman Islands / Panama / Switzerland / Lichtenstein / Monaco (and save you some coin on airfare).

- Regulation: Truly decentralized gambling application means that it’s everywhere and nowhere — how can a government regulate?

The counterarguments are plentiful. For example — participants in dApp gambling apps still need to convert their tokens to fiat at some point in time if they want to splurge on that big night out at Magic City to celebrate their winnings. The regulatory bottleneck becomes the cryptocurrency trading platform of which the largest ones are still centralized companies subject to national / regional laws.

The Data: 15 completed ICOs, USD 75M raised

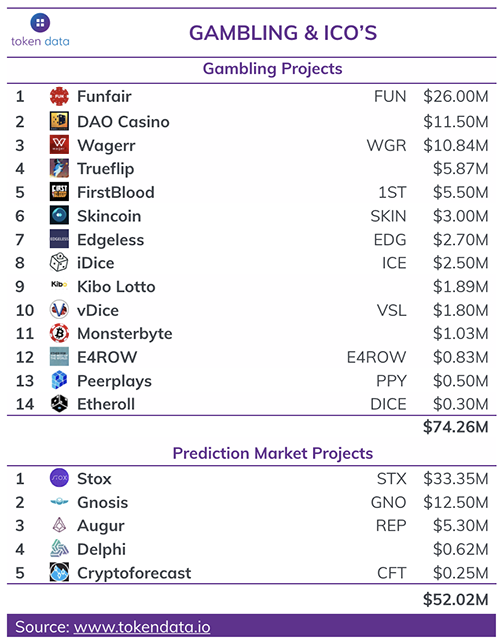

If we look at ‘pure’ betting & gambling ICOs — ICOs that specifically mention betting, gambling, casino — we count 14 successful ICOs that raised a combined total of USD 74M. The projects range from outright decentralized lotteries and casino games, to platforms that will help developers launch decentralized gambling applications.

If we include ICOs focused on prediction markets — an overlapping area — the number increases to 20 ICOs with a total of USD 126M raised. That’s still less than the $160M George Clooney & Co steal in the epic 2001 remake of the Rat Pack original, but still a hell of a lot more than any betting company has raised in “traditional” capital markets. And, by our count, there are still 13 gambling / betting related ICOs either active or planned in 2017.

Wrapping It Up

Whether the pace at which decentralized gambling applications are raising funds is sustainable, whether regulatory institutions will find a way to curb these gambling ICOs, and whether the gambling projects listed are truly decentralized ventures remains to be seen.

With that in mind, we want to extend another 1997 excerpt past gambling to drive home the broader implications of decentralization and blockchain technology (again, our replacements in bold, below)

Online gambling (The ICO market) is on the list of issues set to be examined by the president’s commission on gambling (decentralization). But that commission remains on a slow track, while the growth of the online gambling (digital currency) industry is, to say the least, brisk.

Having said that — with the rate at which our current President’s commissions are disbanding, we may not have anything to worry about for quite some time…

Cheers,

The TokenData team

[addtoany]Introducing TokenData

Friday, July 14, 2017Séamus and the Giant ICO Peach: Our journey to get all token data.

‘Man, this ICO sh*t is out of control’, has been the modal phrase uttered at TokenData for the past several weeks. For anyone interested in technology and finance, who has been even half-sentient this year, this sentiment should strike a chord.

We created Tokendata.io out of some nouveau sense of civic duty. After our latest: ‘So what do you think of these coin things?’, encounter with a group of quaintly-naïve Baby Boomers, it became self-evident: the time for transparency is now.

In prior lives, we at TokenData held various roles in the shadow banking system — once upon a crisis, the media’s favorite target in demonizing modern finance. Never before though have we witnessed anything cast shade remotely as parabolically as today’s ICO market.

We’re talking insanity, folks. We’re talking about about ex-bankers setting up crypto hedge funds when they don’t know what Github is. About pump-and-dump discussions and scams in official ICO channels that make our old LIBOR fixing chats on Bloomberg look like jaywalking.

It’s as if someone opened the Tesseract three months ago, and only the geeky kids feel compelled to stop the Demogorgon (Netflix & chill — Google it).

We ❤ Tokens

Still reading? Good. It’s not all doom and gloom. We love the ICO market as much as anyone — not in the: ‘Let’s throw up a WIX page tonight and raise a buck selling ClitCoins (borderline NSFW) tomorrow’ kind of way, but in the: ‘Wow we’re witnessing true innovation in capital raising and business models’ kind of way. The TokenData team uses Basic Attention Token’s Brave browser and we can’t wait to put our emotional hedge before the next U.S. election on Augur or Gnosis.

Put more eloquently by our Twitter hero Naval Ravikant we believe that ‘We’re going through a phase of irrational exuberance, but long-term rational exuberance.’

Sometime after this frenzy, out of the ashes of failed projects, in a place that most certainly won’t be the “distributed ledger” / “blockchain working group” / ”innovation lab” of a bank, token sales and ICO’s might emerge as a monumental paradigm shift in the financing world. Why? Because we, and many of you, have taken the leap and believe that blockchain protocols and decentralized applications are useful and will lead to new, innovative business models. Tokens and ICO’s are essential to that future.

TD’s Modus Operandi

Our mission: Full transparency. For now, that means a complete^ and free repository of data. TokenData.io, in its current form, is the optimal entry point in our efforts to pull back the curtain for an audience of varying levels of sophistication and give-a-sh*t-ness. No matter where you fall on the spectrum, TD has something for you:

- Completely new to cryptocurrencies?

If you’re browsing through more than 10 of these ICO’s you’ll probably go down the rabbit hole of browsing through all 250+ ones that we’ve listed. - Blockchain-focused VC?

Check fundraising stats and relative performance measures for 75+ and counting projects. - Crypto diehard since pre 2010?

Find all upcoming ICO’s in one place and at the same time look at why you HODL. - Blockchain skeptic?

Read some of the ICO descriptions and you’ll find what you’re looking for.

‘But TokenData, there’s much more to this than simple returns.’

Yes, of course. The devil is in the details, after all. One nefarious line of code in a contract is enough to make any attempted calculation of returns an exercise in absurdity.

That’s why we will be publishing a constant stream of content, developing easy to use analytical tools, and conducting interviews throughout the token space. Lofty goals, indeed. But for now, at a minimum, we’ve done the grunt work to get the ball rolling for everyone.

Simple Insights Derived from our Data

$1.5 BILLION has been raised through 91 ICO’s year-to-date. That’s more than all VC investments in the blockchain space in 2015 and 2016 COMBINED*. At time of writing, there are ~70 upcoming ICO’s, and this number is growing by the day.

We’ve estimated the (simple) average return of our complete universe of traded ICO’d tokens to be 16x, versus 13x for Ethereum and 2x for Bitcoin**. Of course, in calculating relative returns, you can datamine and use different methods however you want. That’s why TokenData provides you with prices, absolute and relative returns for every single token, and you can draw any conclusion you want.

On Due Diligence, Accountability

Most projects and investors tend to have concerns about pricing, thresholds, and trading liquidity. We’ve dug through all token sales websites, white papers, blogs, chat rooms and Twitter feeds to collect the data. Following this due diligence we believe that there are essential best practices only few token sales follow:

- Be Fully Transparent:

Transparency goes beyond showing fancy pie-charts of token distribution, usage of fiat funds and an overview with people’s LinkedIn’s pictures. - Provide Regular Status Updates:

Evaluate and document progress (or lack thereof) towards promised goals & milestones. One of the early landmark token sales, Augur, has done a great job at publishing a weekly update of the development work and an updated masterplan/roadmap of what’s to come and what might fail. - Open Your Codebase to 3rd Party Auditing:

Tokens == Code. Open-sourcing the codebase for your tokens is essential to gain trust. Respond to any findings that point at flaws in your smart contract code, and address the necessity for such terms before raising funds.

For example: Storj, Golem, and the Basic Attention Token projects all had their smart contract code reviewed and publicized by an independent third party (Zeppelin). - Stick to the Plan:

If you say that a token sale will take two blocks, two hours, or two months, stick to it and don’t change it during or after a sale. Bancor raised $153M in an afternoon, but not without disputes when the sale window was extended. You’ve set a fixed token:crypto exchange rate? You should stick to it and hedge accordingly. Civic did a great job with their transparent exchange rates and ‘take it or leave it’ approach.

Yes, we can hear the footsteps of the impending wave of trolls. No, we’re not that naive. We understand the intricacies and difficulties involved in reforming the ICO market as much as anyone who’s read this far.

But rather than passively observe a slow-motion train wreck, we want to help lay out a path forward of common sense.

TokenData’s Favorite Due Diligence Blunders

Lest we take the windfalls and tribulations of building TokenData.io too seriously — we tender for your enjoyment particularly noteworthy moments of astonishment on our side:

TenX — https://tenx.tech/

TenX wants to bring crypto to the masses through a wallet and debit card solution. They’ve raised 80M USD in their ICO, provided development updates, launched an early release of their wallet app and worked with different exchanges to create a liquid market for its PAY tokens. This is more positive development than 90% of the projects out there.

But when we see a Twitter feed insinuating that PAY will go to the moon once trading starts and a subsequent blog post which states that “holding PAY was by far the best option compared to other cryptocurrencies” and that “we want to congratulate everyone who bypassed the massive crypto hit over the past few weeks by being in PAY”, we’re simply dumbstruck.

It gets worse, TenX even has the audacity to quote Warren Buffet in the blog post. We thought TenX was a blockchain company focused on developing a consumer application, and not a fund-selling Cryptocurrency Portfolio Insurance. The Sage of Omaha would not approve…

Veritaseum — http://veritas.veritaseum.com/

P2P Capital Markets platform meets personal blog meets random images of golden coins. Can someone please explain to us what they do, and why the website asks us to “imagine having the keys to the Internet in 1994”? The only image this conjures to the frontal lobe is Mother picking up the phone in the middle of an angsty AIM chat, as the ol’ 28.8k modem gives out. *DAMMIT Maaaaa, come on..*

Paquarium — https://ico.paquarium.com/

SPOILER ALERT: Finding Nemo fans, avert your eyes as we find it fitting to quote the most memorable line of the latest, upcoming episode in the blockbuster trilogy, Finding Nemo 3:

“Everyone on the planet understands the nature of water and fish.” ~ Dory

Profound, isn’t it? Only kidding — this line was pulled verbatim from the whitepaper accompanying Paquarium’s ICO! Paquarium is looking to build the world’s largest aquarium. In an effort to raise $120M through an ICO, we were less surprised by the proposed functionality of the tokens (fancy souvenir vouchers with a coupon) than we were by the fact that the executive team lacks actual professional aquarium management / construction experience. Have we mentioned that the goal of this ICO is to build a f**king aquarium?!? Please tell us this is a prank-ICO.

That’s All Folks!

If you feel slightly incensed after reading those last blurbs, it’s likely because you either:

- invested in one of the aforementioned issuances, or

- you’re behind one of them.

In either case you’ll want to cruise on over to our Returns page, to keep tabs on how your guac’ is faring relative to the market.

Just remember: We all make mistakes

— and, after all, isn’t failure the key to success?

Whether you find these anecdotes worrying or hilarious, you’ll want to check back with TokenData regularly. The site and forthcoming content will make our journey down the digital currencies rabbit hole easier and just that much more fun.

Necesitamos Feedback

If you like what we’re creating here, please spread the word, sign up to our newsletter, and follow us on Twitter: @tokendata. If you want to help us with any form of content creation or data collection hit us up on: [email protected]. If you think some of the data is incomplete, or that certain calculations or commentaries don’t make sense, feel free to do all of the above.

Cheers & Good Luck,

TokenData

Endnotes:

^We do our best to keep TokenData.io as encompassing as humanely possible — but these issuances are coming at warp speed!

* https://www.cbinsights.com/blog/bitcoin-blockchain-startup-funding/

** Simple average of individual returns, where an individual return is measured as investing $1 in tokens/ETH/BTC at time of an ICO

Disclaimer: In the spirit of full transparency, the TokenData team have invested and/or participated in the following tokens and token offerings: BTC, ETH, GNO, BAT, BCAP, STORJ, CIVIC, ARAGON, TEZOS, BANCOR, STATUS, AUGUR (REP)

[addtoany]