The State of Crypto M&A 2021

Wednesday, May 26, 2021This is our third landmark publication about M&A activity in the cryptocurrency sector.

TL;DR: Crypto M&A activity points at an industry that is in a much better state than the 2017-18 cycle.

If you want to keep a firm handle on what is moving the crypto industry then keep reading and download the full Crypto M&A report for free here:

Enter email to receive a link to download the survey results

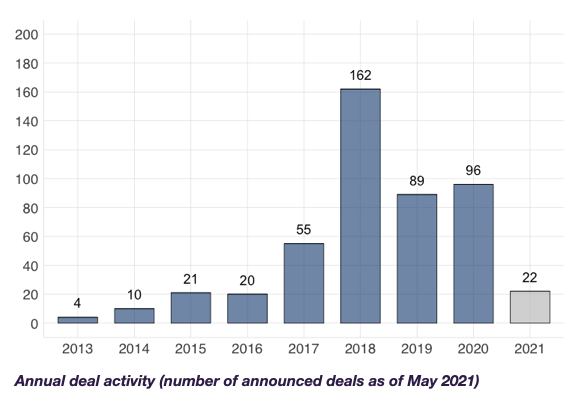

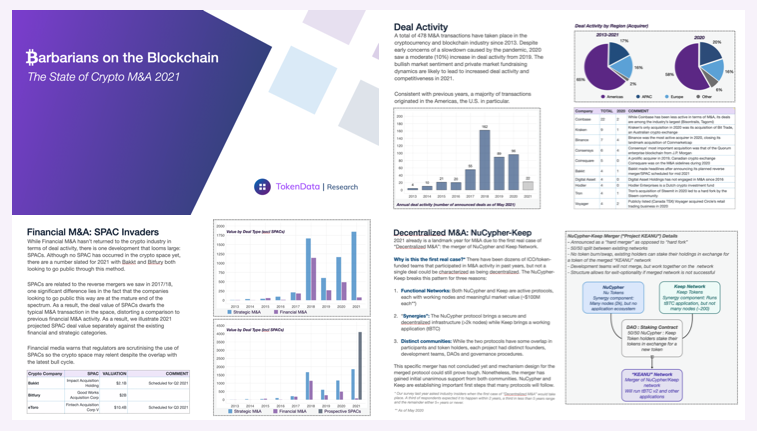

Deal Activity: Steady stream of transactions

A total of 478 M&A transactions have taken place in the cryptocurrency and blockchain industry since 2013. Despite early concerns of a slowdown caused by the pandemic, 2020 saw a moderate (10%) increase in deal activity from 2019. The bullish market sentiment and private market fundraising dynamics are likely to lead to increased deal activity and competitiveness in 2021.

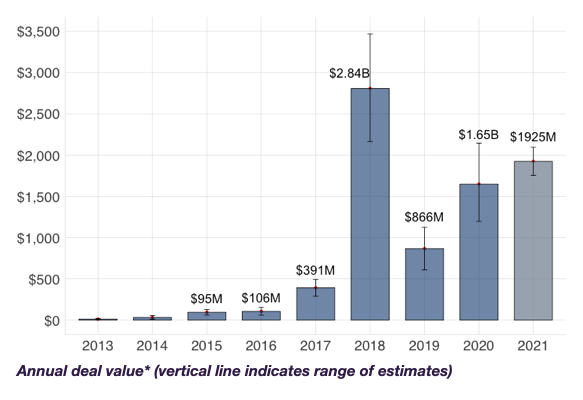

Deal Value: New records are set

While deal activity in 2020 increased only 10% over 2019, total deal value doubled to $1.7B. This was largely due to a handful of large acquisitions in the exchange space including the $400M acquisition of Coinmarketcap by Binance and FTX-Blockfolio transaction for $125M. This trend has continued into 2021, culminating in the record setting Galaxy Digital acquisition of BitGo ($1.2B). This transaction has caused 2021 ytd to leapfrog 2020. Barring a sudden (negative) shock to the crypto market, 2021 is set to become a record year and we expect more billion dollar deals to happen.

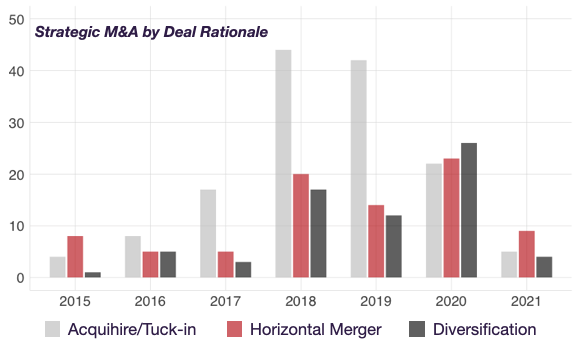

Strategic M&A: Shift towards consolidation

M&A activity falls into two categories: Strategic and Financial. The 2017-18 market cycle saw a rapid increase in Financial M&A when 50% of all activity was financial of nature and caused by investment funds, defunct corporations (e.g. Long Island Blockchain…), and obscure reverse mergers.

Unsurprisingly, this opportunistic activity dropped off when crypto market sentiment turned in 2018-19.

Deal activity has been predominantly strategic since, and a closer look reveals a maturing industry that is shifting away from acquihires and smaller “tuck-in” acquisition towards larger horizontal and diversification mergers.

Sectors: Exchanges and Crypto banks are dominant

Exchanges have consistently been the most prolific acquirers in crypto contributing more than 40% of all deal activity and 60% of deal value since 2013. Through multiple acquisitions in the custody, brokerage and infrastructure subsectors, incumbents such as Coinbase, Kraken and Gemini have evolved into full service crypto banks. The institutionalisation of crypto, bullish fundraising climate and Coinbase IPO will lead to increased M&A competition in 2021 between exchanges and other crypto financial services companies. The first billion-dollar takeover (Galaxy Digital – BitGo) and trading venue acquisitions by Coinbase (Skew) and Blockchain.com (AiX) are signs of what’s to come.

Decentralized M&A: NuCypher & Keep Network

2021 already is a landmark year for M&A due to the first real case of “Decentralized M&A”: the merger of NuCypher and Keep Network.

Why is this the first real case? There have been dozens of ICO/token-funded teams that participated in M&A activity in past years, but not a single deal could be characterized as being decentralized. The NuCypher-Keep breaks this pattern for three reasons:

- Functional Networks: Both NuCypher and Keep are active protocols, each with working nodes and meaningful market value (~$100M each)

- “Synergies”: The NuCypher protocol brings a secure and decentralized infrastructure (>2k nodes) while Keep brings a working application (tBTC)

- Distinct communities: While the two protocols have some overlap in participants and token holders, each project had distinct founders, development teams, DAOs and governance procedures.

This specific merger has not concluded yet and mechanism design for the merged protocol could still prove tough. Nonetheless, the merger has gained initial unanimous support from both communities. NuCypher and Keep are establishing important first steps that many protocols will follow.

Full Report

Download the full report to get a detailed breakdown of each of these topics and data-driven forecasts.

Enter email to receive a link to download the survey results